I’d like to thank all of our landlord clients who we have worked for this year. Some of you have trusted us for many years, some of you are new this year. Merry Xmas to one and all.

Our firm is growing and we have made great strides this year. Notable thanks must go to Emily who joined us in the Spring, whom many of you will have met, and Marc our Marketing Manager. Our extended team of industry professionals, contractors and suppliers also make a vital contribution to serving our landlords.

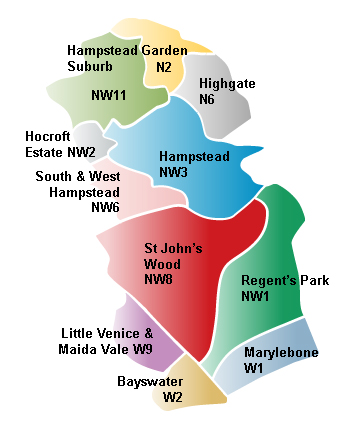

Our marketing is paying off and we are trumping the big players on a regular basis. If you have a rental property within a square mile of our office, I can’t think of a single reason why you would choose one of the big high street agents over ourselves – we can discuss over a coffee if you wish…

Article:

Rent or Sell?

Whilst the majority of our landlord clients are sticking with their rental investments, it has been interesting to talk to some that are considering selling.

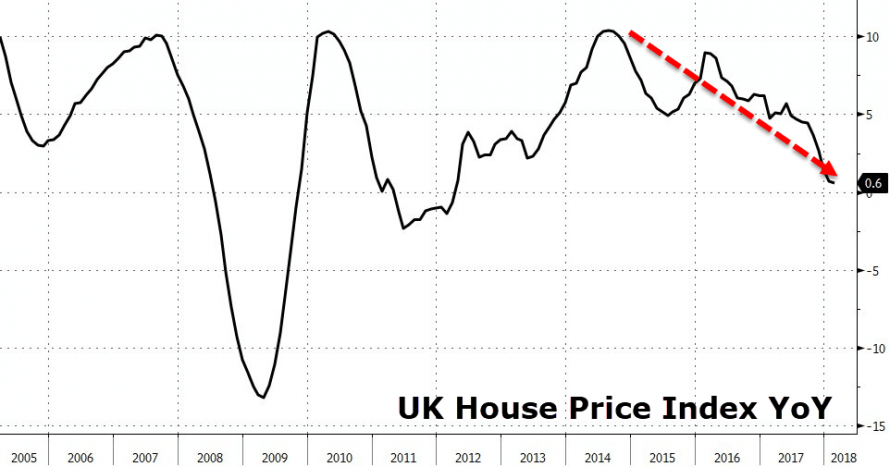

A notable trend this year has been when a tenancy ends, it goes to market for re-let, it doesn’t fly off the shelf as it did last time, the landlord receives conflicting advice from competing agents about price, it then remains empty for some weeks. The landlord then decides they’d rather sell, adding that the dark clouds on the horizon justify the action.

If you decide to sell, receiving your asking price is no longer a given either. If you weren’t prepared to drop the price a few pounds on a rental, will you be prepared to slash the sales price tens of thousands of pounds to get it sold?

The decision to sell should form part of an overall strategy and not an immediate reaction to short-term fluctuations in the market. Your long-term returns are driven by other factors: capital appreciation, leverage and compounding.

Houses prices will vary, but over a 5 or 10 year period would many would argue against planning for an average 3%pa increase? The historical average since WWII is 8%pa. Combined with net income reinvested and when compounded over that period, you will receive impressive returns. At 3%pa growth, a £1m flat will provide £150k in pocket money every 5 years or so, whilst maintaining a sensible Loan To Value.

When you sell an asset you are no longer invested and you will not be party to any windfalls. Can you do better with the money? Development is many landlord’s other business. Finding the right site at the right price and sticking to a budget is the trick here. The best way to stick to a budget is to budget correctly in the first place. Without experience this is very difficult to do.

The same can be said for a play on the Stock Market. If you are a savvy investor, returns can be attractive. But those that consistently succeed in this arena do so with no small amount of work. They are experts in their field, just as you are in property.

Lastly, if you were to sell a stock that you had held for sometime, a stock that had served you well, you would only do so if there were factors such as a possible collapse in future earnings, a fundamental change in demand for the good or service, a cultural shift that rendered your stock worthless. You wouldn’t sell just because the CEO had revised down earnings and dividends by only a small percentage. No, you wouldn’t jump ship. You may watch others panic and then you would just buy their same stock for less.

The fundamentals of investing in residential real estate haven’t changed and whilst there is volatility from time to time, stick with your guns and invest for the longer term.

Here’s to a positive 2019.